Bidenomics is going great for you and me.

Home mortgage rates just hit 7.23%, the highest rate in decades.

US mortgage rates soar to 7.23%, their highest level since 2001 https://t.co/VhZE57nZVL

— CNN (@CNN) August 24, 2023

CNN tells us that this is somehow good news, showing that the economy is roaring and happy days are here again. Sure, housing has never been this unaffordable in US history, but that is only because Biden has done such great things for the economy.

No, really. That is the explanation. It has nothing to do with all that money printing, inflation, government spending, or gross overregulation. It is the great economic times we have been having.

US mortgage rates surged again this week, rising to their highest level since 2001.

The 30-year fixed-rate mortgage averaged 7.23% in the week ending August 24, up from 7.09% the week before, according to data from Freddie Mac released Thursday. A year ago, the 30-year fixed-rate was 5.55%.

Indications of ongoing economic strength will likely keep mortgage rates where they are or send them higher in the short term, said Sam Khater, Freddie Mac’s chief economist.

Rates have been above 6.5% since the end of May and have been climbing higher since mid-July. Prior to last week’s rate, the last time rates were over 7% was in November of last year, when they hit 7.08%.

This week’s average rate is the highest the 30-year, fixed-rate mortgage has been since the week ending June 1st, 2001, when it was 7.24%.

Just to put this in perspective, the last time interest rates were this high for mortgages the economy was in recession. Really. Look it up.

But whatever. Under Biden it is different. Times are so good that houses are unaffordable.

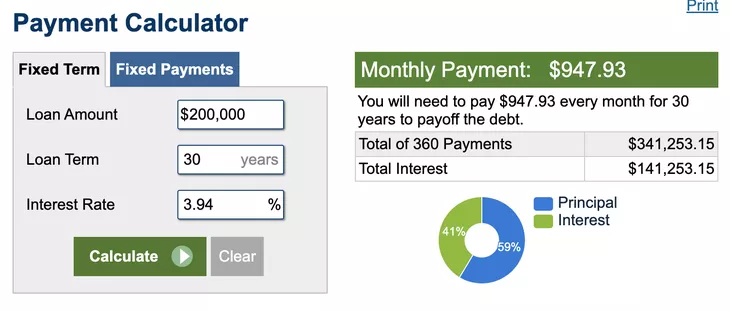

Back in the bad ol’ Trump days the economy was sucking wind, as I recall, so interest rates were much lower. I went and looked up what they were in 2019 (I picked a pre-pandemic time because rates dropped like a rock during the pandemic, and I wanted to be fair) and they averaged 3.94%. They hit a low of 2.65% during the pandemic, but using that number would be unfair.

So I hit a mortgage calculator to see the difference in costs between the two rates. The 2019 average and today’s number.

The difference? You would pay $150,000 more for the same loan today than in 2019, and $400+ more a month. With the same loan.

Not to mention that house prices went up in the interim, so you will pay more and get less with the same loan.

Prices for Housing, 2019-2023 ($200,000)

According to the U.S. Bureau of Labor Statistics, prices for housing are 19.37% higher in 2023 versus 2019 (a $38,739.95 difference in value).

Between 2019 and 2023: Housing experienced an average inflation rate of 4.53% per year. This rate of change indicates significant inflation. In other words, housing costing $200,000 in the year 2019 would cost $238,739.95 in 2023 for an equivalent purchase. Compared to the overall inflation rate of 4.33% during this same period, inflation for housing was higher.

In the year 2019: Pricing changed by 2.89%, which is below the average yearly change for housing during the 2019-2023 time period. Compared to inflation for all items in 2019 (1.81%), inflation for housing was higher.

If the Biden economy gets any better we will all be joining San Francisco’s homeless population on the streets.

Bidenomics. Is there anything it can’t make worse?

Read the full article here